The Complex World of Sales Tax on Beauty Products: A Comprehensive Guide

Related Articles: The Complex World of Sales Tax on Beauty Products: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Complex World of Sales Tax on Beauty Products: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Complex World of Sales Tax on Beauty Products: A Comprehensive Guide

The beauty industry, a multi-billion dollar global enterprise, encompasses a vast array of products, from basic toiletries to advanced skincare regimens. While the allure of these products is undeniable, navigating the complexities of sales tax regulations can be a daunting task, particularly for businesses operating within this industry. This article aims to provide a comprehensive overview of sales tax rates applied to beauty products, highlighting the factors influencing these rates and the implications for both businesses and consumers.

Understanding the Fundamentals of Sales Tax

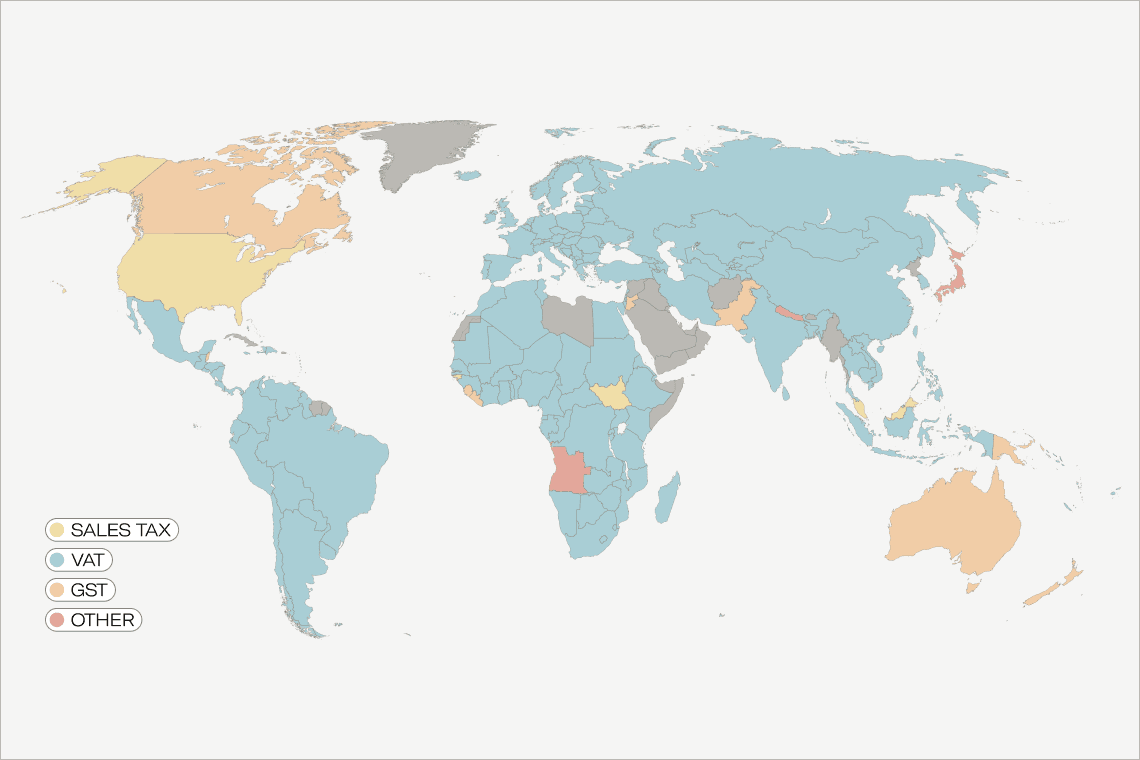

Sales tax, a consumption tax levied on the sale of goods and services, is a significant source of revenue for state and local governments. While the fundamental purpose of sales tax is to generate revenue, its application to specific products can be complex and vary considerably depending on the jurisdiction.

Beauty Products: A Diverse Landscape

The definition of "beauty products" encompasses a broad range of items, including:

- Cosmetics: Makeup, lipstick, eyeshadow, foundation, blush, mascara, eyeliner, nail polish, and other products intended to enhance or alter the appearance.

- Skincare: Cleansers, toners, moisturizers, serums, masks, sunscreens, and other products designed to care for and improve the condition of the skin.

- Haircare: Shampoos, conditioners, styling products, hair dyes, hair treatments, and other products for hair maintenance and styling.

- Fragrances: Perfumes, colognes, and other scented products.

- Personal Care: Bath and body products, soaps, lotions, shaving products, and other items used for personal hygiene.

The Role of State and Local Regulations

Sales tax rates for beauty products are primarily determined by state and local regulations. Each state has its own unique sales tax system, with rates varying significantly. Furthermore, local governments within a state may impose additional sales taxes, further complicating the tax landscape.

Exemptions and Exceptions

While most beauty products are subject to sales tax, there are some notable exceptions and exemptions. These can include:

- Prescription Medications: Products prescribed by a physician for medical conditions, including certain topical medications, are typically exempt from sales tax.

- Medical Devices: Certain medical devices, such as prosthetic limbs or devices for managing chronic conditions, may be exempt from sales tax.

- Essential Items: Some states may exempt certain essential items, such as diapers or feminine hygiene products, from sales tax.

The Impact of E-Commerce

The rise of online shopping has significantly impacted the sales tax landscape for beauty products. Businesses operating exclusively online may face different tax obligations compared to brick-and-mortar stores. States are increasingly implementing "economic nexus" laws, which require businesses with a certain level of sales or activity within a state to collect and remit sales tax, regardless of their physical presence.

Navigating the Sales Tax Maze

For businesses selling beauty products, understanding the intricacies of sales tax is crucial. Failure to comply with tax regulations can result in penalties, fines, and even legal action. Several resources can assist businesses in navigating this complex landscape:

- State Tax Agencies: Each state’s tax agency provides comprehensive information on sales tax requirements within their jurisdiction.

- Tax Professionals: Consulting with a qualified tax professional can offer valuable guidance on specific tax obligations and ensure compliance with all relevant regulations.

- Tax Software: Software programs designed for tax compliance can automate sales tax calculations and filing, streamlining the process for businesses.

Consumer Considerations

While businesses are primarily responsible for collecting and remitting sales tax, consumers should be aware of the impact of sales tax on the final price of beauty products. When making purchasing decisions, consumers should consider:

- Total Cost: The final price of a product includes both the original price and the applicable sales tax.

- Sales Tax Rates: Consumers should be aware of the sales tax rate in their jurisdiction to understand the potential impact on their purchases.

- Tax-Free Events: Some states may offer tax-free shopping days or periods for certain products, including beauty items.

Conclusion

Understanding the sales tax landscape for beauty products is essential for both businesses and consumers. By navigating the complex web of state and local regulations, businesses can ensure compliance and minimize financial risks. Consumers, in turn, can make informed purchasing decisions, factoring in the impact of sales tax on the overall cost of their beauty products.

FAQs

Q: How do I find out the sales tax rate for beauty products in my state?

A: You can find this information on the website of your state’s tax agency.

Q: Are there any specific tax exemptions for beauty products?

A: Some states may exempt certain products, such as prescription medications or medical devices, from sales tax. However, specific exemptions vary by state.

Q: What if I sell beauty products online?

A: Businesses selling online must comply with the sales tax laws of every state in which they have "economic nexus." This means they must collect and remit sales tax if they meet certain thresholds for sales or activity within a state.

Q: What are the potential consequences of not paying sales tax?

A: Failure to pay sales tax can result in penalties, fines, and even legal action.

Tips

- Stay informed: Regularly check for updates to state and local sales tax laws.

- Use tax software: Software programs can streamline sales tax calculations and filing.

- Consult with a tax professional: Seek guidance from a qualified tax professional to ensure compliance with all relevant regulations.

- Be transparent with customers: Inform customers about the sales tax rate applicable to their purchases.

Conclusion

Navigating the complexities of sales tax on beauty products requires a thorough understanding of state and local regulations. By adhering to these regulations, businesses can operate within the legal framework and avoid potential penalties. Consumers, in turn, can make informed purchasing decisions, factoring in the impact of sales tax on the final price of their beauty products. The beauty industry, with its diverse array of products and services, presents unique challenges and opportunities within the realm of sales tax. By staying informed and seeking professional guidance, businesses and consumers alike can navigate this complex landscape effectively.

![Highest Taxed Countries in the World [Updated 2024]](https://blog.mirrorreview.com/wp-content/uploads/2023/11/3-2.jpg)

Closure

Thus, we hope this article has provided valuable insights into The Complex World of Sales Tax on Beauty Products: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!